Motorcycle insurance garage clause | Is your bike covered within 500m?

By John Milbank

Consumer Editor of Bennetts BikeSocial

21.03.2023

It’s not uncommon to hear angry voices on forums or in pubs that insurers refuse to pay out for motorcycles that have been stolen within half a mile of the owner’s home. But this is actually a significant generalisation that doesn’t get very close to the truth at all. Let’s find out what the ‘garage clause’ really means…

The garage clause, or ‘Compulsory Garaging Requirement’

Your insurance documents are a contract between you and the underwriter of your policy: put simply, it’s an agreement that they will do what they promised, if you do what you promised.

You’ll probably have bought your insurance from a broker (like Bennetts), who will have used the information you gave them to find the best policy from their panel of underwriters. The broker will also be your point of contact if you need to make a claim, or if you have any questions about your policy, which is why many riders agree that it’s worth buying their insurance from a quality broker, but more on that later.

In many cases, if you say you keep your bike in a garage when taking out motorcycle insurance, you could have what’s called an ‘endorsement’ applied. Whether this garage clause (which might be labelled as a ‘Compulsory Garage Requirement’) appears on your document will depend on things like the bike you’re insuring (some bikes are more attractive to thieves than others), the theft statistics of the area you live in, and whether you’ve had a bike stolen before.

But it is absolutely not as simple as it ‘not being insured within half a mile of your home’ – it’s more complicated, but usually in your favour. Oh, and when it does appear, it’s usually within 500m as the crow flies (you can use Google maps to measure what falls within that)…

Is my motorcycle insured if I Ieave it outside the garage?

I currently have two bikes insured through Bennetts – a 2019 BMW R1250GS and a 1999 Kawasaki ZX-6R. Both are underwritten by a company called Highway, but both have different garage clauses / endorsements. For my BMW I have the following clause, which is also known as an endorsement:

Example 1: Compulsory Garaging Requirement

Section 1 of the policy booklet will not cover you for theft or attempted theft of your motorcycle unless, between 10.00 pm and 06.00am it is kept in a locked building or garage whilst at your place of residence or at another address which has been specifically agreed with us.

This means that if I had stopped at a shop that was – for instance – 300m away from my home at any time of day or night, I would still be covered for theft or attempted theft as it’s not my place of residence. However, if I got home at 10.30pm and left my bike outside while I went for a wee and it was stolen, the underwriter could deny my claim (they call it repudiation).

This is different though to the clause that’s in place on my Kawasaki policy:

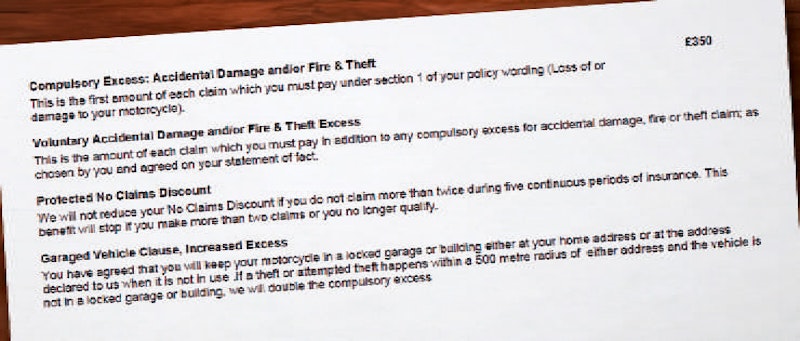

Example 2: Garaged Vehicle Clause, Increased Excess

You have agreed that you will keep your motorcycle in a locked garage or building either at your home address or at the address declared to us when it is not in use. If a theft or attempted theft happens within a 500 metre radius of either address and the vehicle is not in a locked garage or building, we will double the compulsory excess.

With this policy, if my bike was stolen from that same shop 300m away from my home – at any time of the day or night – the compulsory excess would doubled. That means the underwriter wouldn’t pay the first £700 of the claim, rather than £350. If I also had a voluntary excess that I’d chosen to add, this would remain the same. Of course, £700 is close to what the bike’s worth really, but given that there are no places I ever stop and leave my bike within 500m of my home, I’m happy to accept this clause.

Any endorsements (or clauses) on your motorcycle insurance should be clear and easy to understand. This is from my own ZX-6R policy documents

But that’s not all you might find – here are a couple more examples that could appear on some policy documents from Bennetts where a garage clause in in force. It’s important to note that there might be different clauses from other insurance brokers, and that the language could be different.

Example 3:You have agreed that you will keep your motorcycle in a locked garage or building either at your home address or at the address declared to us when it is not in use. If a theft or attempted theft happens within a 500 metre radius of either address and the vehicle is not in a locked garage or building, you will not be able to claim for theft or attempted theft.

In this case, if you stopped at a shop 300m from home – for example – your bike would not be covered for theft.

Example 4:You have agreed that you will keep your vehicle in a locked garage or building at your home address. If a theft or attempted theft of your vehicle happens within a 500 metre radius of your home address when the vehicle is not locked in this garage or building we will not pay the claim. This restriction does not apply to any loss or damage occurring whilst your motorcycle is parked during the course of a journey.

With this clause, your bike is still not insured for theft or attempted theft at any time of the day or night if it’s left unattended within 500m of your home, but stopping at the shops would most likely be counted as being ‘on a journey’.

Whether you see one of the four clauses shown above – or something different – will depend entirely on your own circumstances, and your insurer.

What if I get knocked off my bike within 500 metres of my home?

If your motorcycle insurance policy has a garaging endorsement, as can be seen from the example above it doesn’t relate to any damage or loss caused by a collision while you’re riding, for instance. Another variation on a garage endorsement might be:

Section 1 of the policy booklet will not cover you for theft or attempted theft of your motorcycle unless, between 10.00 pm and 06.00am it is kept in a locked building or garage whilst at your place of residence or at another address which has been specifically agreed with us.

Again, this clearly relates only to claim regarding a theft or attempted theft.

Where to find the garage clause in your documents

A good motorcycle insurance broker will provide clear, easy-to-understand documents when you take out your policy, which you really must read and understand.

The garage clause on my two policies appears on the page after the ‘Policy Schedule & Endorsements’ and is immediately obvious: it doesn’t require me to wade through pages of unintelligible legal speak.

If you buy your insurance over the phone, Bennetts insurance agents will tell you about the garage clause if it’s been applied, but if you’re unsure, just ask. Equally, if you don’t understand any point of your insurance, you should contact the company you bought it from. With Bennetts, you can use webchat or call to speak to an agent if you have any questions at all.

Other motorcycle insurance clauses and endorsement you should be aware of

It’s a bit of a trope that insurers will do all they can to ‘wriggle out of paying’, however your insurance documents should clearly state what terms and conditions you’ve agreed to in entering into that contract.

Frankly, it makes no financial sense to build a reputation for not paying out on valid claims, which is why a reputable motorcycle insurance broker – like Bennetts of course – will do all it can to ensure that its customers are aware of any endorsements or clauses that apply.

Companies that don’t treat their customers fairly rarely last forever.

When a claim is denied / refused / repudiated by an underwriter, this shouldn’t be a surprise to the customer of a good broker. To help you get an idea of where policy holders can sometimes fall foul of clauses and endorsements, here are some past claims that saw the policy cancelled, which also means the claim was denied:

The policy holder purchased cover at 13:30 then proceeded to make a claim. However, investigations showed that the incident took place at 13:10, so there was no cover was force at the time of the incident.

The policy holder was commuting at the time of incident, but had only purchased insurance for Social, Domestic and Pleasure (not Commuting).

A motorcycle was stolen while being ridden to work, but the policy-holder did not have commuting cover.

The policy holder’s motorcycle was stolen from a car park – which is where it’s kept regularly – but it had been agreed that the bike was kept in a garage overnight.

Another motorcycle was stolen from the policy-holder’s garden, despite the clause in their documents stating that it would be kept in their garage overnight.

Looking at them logically, the above will be fairly obvious breaches of the terms and conditions to the majority of people, but insurers WILL use common sense. For instance, a recent claim saw a motorcycle stolen from an underground car park: while this was initially flagged for repudiation as the agreement had been made that the bike would be garaged, the policy holder lives in a block of flats and the underground car park is gated and secured, so the claim was settled and the policy holder paid.

How to find a good motorcycle insurance broker

You probably shouldn’t take the word of someone who says a company is good when they work there, so despite BikeSocial having built an enviable reputation of providing honest, reliable reviews and advice to motorcyclists, I’d suggest you check for yourself.

All legitimate insurance brokers and underwriters are overseen by the Financial Conduct Authority, and if a customer has a complaint that isn’t satisfactorily dealt with, they can refer it to the independent Financial Ombudsmen Service (FOS), which will decide whether the complaint should be upheld or not. You should judge a financial provider (and that includes insurance brokers and underwriters) not necessarily on how many complaints have been referred to the ombudsman, but by how many were upheld as the more that are, the more often the provider was at fault and the customer was deemed to have had a legitimate grievance.

Speaking personally here, I was proud to discover what an outstanding record Bennetts has had over its more than 90 years as a motorcycle insurance broker, and I’d urge you to compare its performance with others on the FOS site here.

Potential customers can also look at the Defaqto ratings that offer a guide to the features and benefits provided by financial products, and Trustpilot, which gives customers the opportunity to share their opinions. With this, it’s best to read the reviews to get an idea of what people do – and don’t – like about the company to see how it might affect you.

It would be daft of me not to point out that only customers who buy their motorcycle insurance direct from Bennetts (not via a comparison site) also get BikeSocial membership worth £60 included for free.

What if I don’t agree to an endorsement or clause on my policy?

If you don’t like the clauses or endorsements applied to your policy, you can ask your broker to look for insurance from other underwriters who might have different terms and conditions.

Entering into any contract is always at the choice of all parties involved, so if you don’t like what goes into creating the policy offered to you, you’re free to look elsewhere. You might find that the price increases, or there might be other clauses, but you must always be happy with what you’ve bought.

If you don’t want to accept any form of garage clause on your insurance, you can declare the bike as being left elsewhere, for instance ‘off the road’, which might be on your drive if that’s the case. This could have an impact on your policy price, but if you then decided to keep it in a garage that’s on your own property at the insured address, it’s very, very unlikely that any reputable insurer would have a problem with that. And it’s even less likely that the Financial Ombudsman (see above) would not uphold a complaint by a customer that said the bike was on their property outside, but then put it in a garage at their own address.

What counts as a garage for motorcycle insurance?

Several years ago, Bennetts changed the face of motorcycle insurance by getting its entire panel of underwriters to agree that they would count locked metal sheds, shipping containers and even wooden sheds as being the same as a brick-built garage.

This was in response to a comment on the Bennetts BikeSocial YouTube channel, and made a significant difference for a lot of motorcyclists across the UK.

Some other brokers appear to have followed suit, most likely due to the fact that some of their underwriters will be the same as those who work with Bennetts.

A typical up-and-over garage door has limitations without additional security measures, so a secure wooden shed – for example – can provide as much if not more protection in some cases, hence acknowledgement that getting your bike tucked out of sight behind the locked door of a shed should be recognised as a significant security step.

Endorsements and clauses are not unusual on any insurance policy, but if you don’t fully understand something, don’t be shy – ring your broker or insurer who will explain it to you. Remember too that all calls are recorded and can be accessed if difficulties were to emerge, so everything is in place to ensure YOUR rights would be protected if there were any problems down the line.

Looking for motorbike insurance? Get your bike insurance quote today!

How to make a secure shed

From location and construction to door and internal security – everything you need to know.